6 Things To Consider Before Selling Your Business

Topics covered in this article: Business Owners, Employment, Farming & Horticulture, Succession Planning

Overview

Here’s a thought that we’ll come back to later… “Selling your business, is not running your business”

If you own a business, whether by yourself or with others, the idea of selling will cross your mind.

For some people, selling was always the plan – build a business, grow it, and exit by selling it. For others, a business sale might be triggered by something else. Perhaps it’s time to take a step back, or circumstances have changed and you need to free up capital, or maybe handing over the reins will secure the business and preserve your legacy.

However it happens, deciding to sell is a momentous decision. But how do you go about selling your business, and what does it actually involve?

After reading this guide you will have an insight into:

- The two ways to sell your business

- How to get your house in order and ready for sale

- When to call in your advisors and how to use them wisely

- Data rooms and due diligence, warranties and indemnities, and other deal jargon

- Formulating a deal structure that works for you and your business

- How to navigate a Sale and Purchase Agreement (also known as a SPA).

“Selling your business is not running your business”

Most business owners and founders are experts in their business. But there is more than meets the eye to successfully selling a business and the expertise you have in your own business may not be enough on its own to get the best outcome. There are things that every business owner contemplating a sale should know that you may not be aware of if you haven’t been through a sales process before.

This guide will help demystify the business sale process. It will be most helpful to people who haven’t been through a sales process, and may also be a helpful refresher to those who have. It is targeted at owners of privately held companies looking to sell 100% of their business, but many aspects apply equally to partial sell-downs. We don’t cover everything there is to know, but it will give you a good grounding in some basics, and you and your lawyer can focus on the bigger issues of how to get the best outcome.

The road to selling a business is not always smooth and straight. There are potholes to avoid and detours. A successful sale depends on how well you prepared for the journey.

Start preparing now. We trust that this guide will be a helpful and informative starter for 10.

Want to get advice on selling your business?

Contact our Corporate and Commercial team, reach out to your usual CLM contact, or get in touch with Andy directly, we’d be happy to invest some time for an initial chat to discuss your plans.

1. The two ways to sell your business

There are two ways to sell your business, each has pluses and minuses:

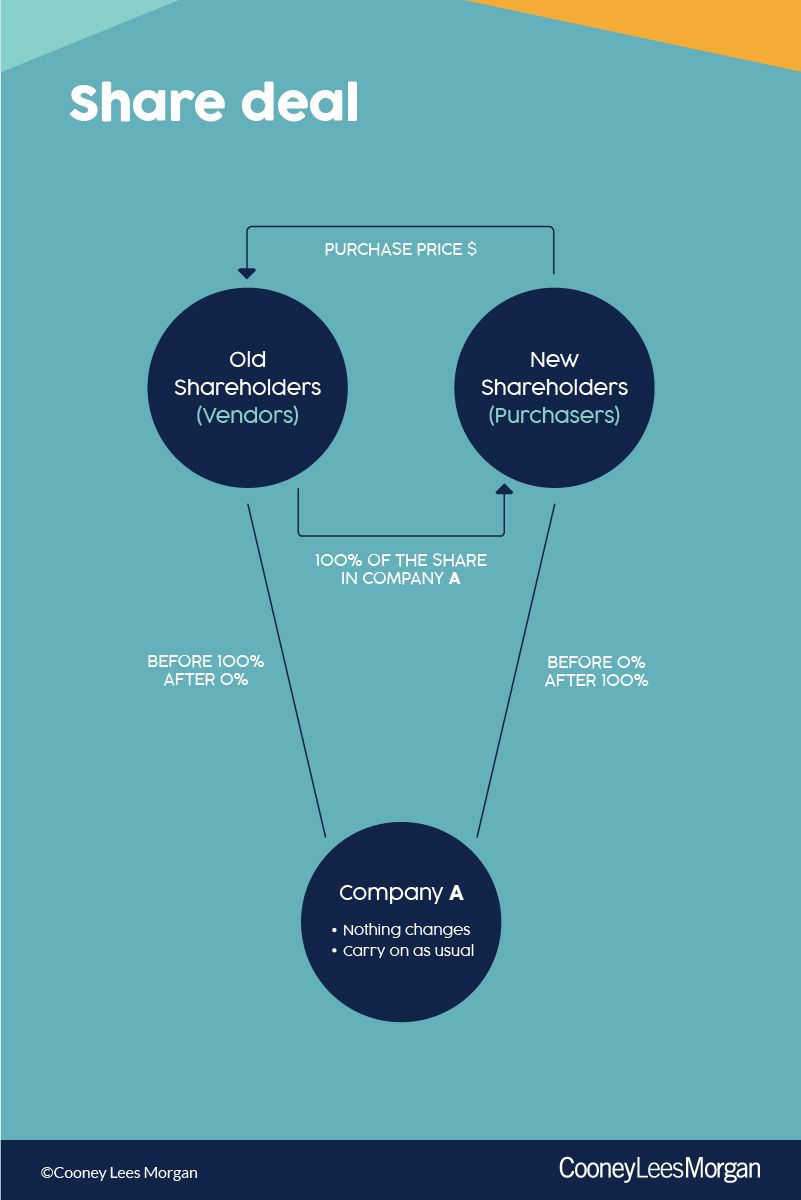

- Share deals – the shareholders sell their shares to someone else, while the company remains unchanged.

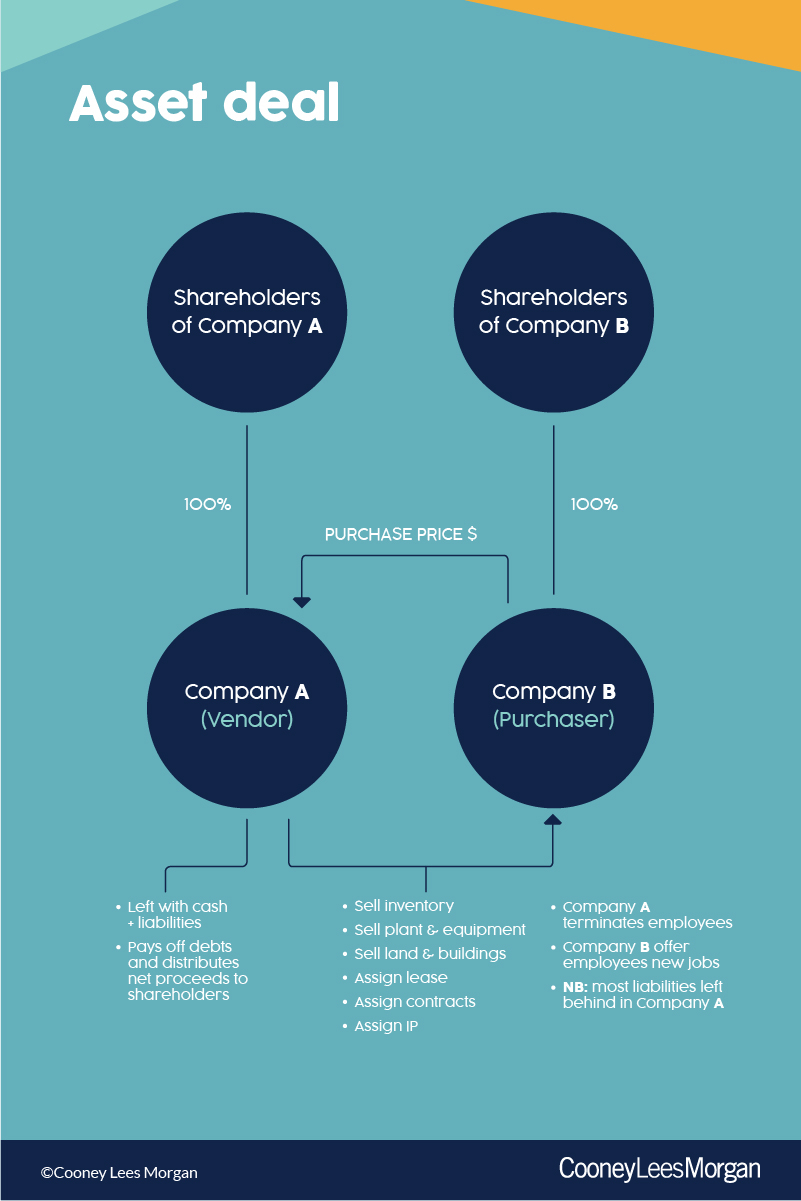

- Asset deals – your company sells its assets & business to a purchaser that will carry on the business

OPTION 1 - SHARE DEALS

The shareholders sell their shares in the company to a purchaser. The sale and purchase agreement is between the current shareholders as vendors, and the incoming shareholders as purchasers. Legally speaking, the company continues to exist.

By acquiring shares, the new owners are buying everything about the company, including its history. They will inherit all the assets and liabilities, whether current, pending or historical, known or unknown. If an IRD audit results in a tax bill and penalties, the new owners have to deal with it.

Therefore, share deals usually involve a higher level of due diligence by the purchaser, and the Sale and Purchase Agreement typically includes purchaser protections in the form of warranties and indemnities, for example a tax indemnity to cover the risk noted above. More on those later on.

The purchase price does not attract GST.

OPTION 2 - ASSET DEALS

The purchaser buys the business and assets from the operating company. The vendor is the company that owns the business and assets, and the purchaser is usually a company that will operate the business once acquired.

“Assets” includes land and buildings, fixed assets, rights and interests under key contracts and leases, intellectual property and goodwill. Employees aren’t “assets” to buy and sell. They need to be transferred in accordance with employment laws. The vendor terminates current employment arrangements and the purchaser offers new employment terms. Getting this right is important.

The purchaser may agree to assume specific liabilities (eg creditors or entitlements of transferring employees) but most liabilities are left behind, remaining the responsibility of the vendor company.

The beauty of asset deals is the ability to cherry pick assets and employees, and leave behind the rest. Receivers and liquidators use this to maximise value realisation for their appointing creditor by strategically selling valuable assets only.

Every asset needs to be formally transferred and delivered on completion. Land and buildings need to be transferred in an e-dealing. Leases and contracts require deeds of assignment or novation. Registered intellectual property rights require formal transfers, as do domain names, websites and vehicles. The physical assets usually remain where they are, but there can be a lot of paperwork to legally and effectively transfer them.

The purchase price attracts GST at 15% unless it is sold as a going concern or an interest in land (like a lease) is transferred or acquired, in which case GST will apply at 0%.

What’s right for me?

Asset deals suit transactions where assets can be readily identified and transferred and the purchaser doesn’t want to take on risk of historical liabilities. Standalone retail, trading or services businesses can be good candidates for asset deals.

Share deals suit larger or more complex businesses, by allowing ownership to change with the least disruption to the actual business.

An asset deal results in the company receiving the purchase price, which means proceeds need to be distributed to shareholders, whereas a share deal puts value directly in the hands of the shareholders.

What does all this mean?

It means talk to your lawyer and your accountant before you strike a deal and get their thoughts on how to structure your transaction. Getting this right will save money later on.

2. Getting your house in order

Have you ever thought about selling your home and then suddenly you look at your house with new eyes and see a myriad of things to tidy up before the open home to make the best impression on prospective purchasers?

Selling a business is the same, but some of the things that deliver value if tidied up may surprise you.

Ask yourself if the business has locked in its value drivers, and if not, what do you need to do? Another way of asking this (if you’re allergic to “management-speak”, like many of us), is what drives the successful operation of your business? How could you objectively demonstrate to a purchaser that the business is in good shape and valuable?

Here’s five basic things to look at and get in order if necessary.

1. Do you own your IP?

Do you have any special technology or important intellectual property? If so, do you own it, licence it, or is the basis on which you use it a bit uncertain? Getting this in order may mean registering trademarks or designs, assigning key IP from founders to the company, making sure employment contracts and services contracts vest new IP in the company; and tidying up who the registrant is for key domain names (hint… it should be the company, not you or your in-house accountant).

2. Are contracts in place for key relationships?

Are key customers or suppliers contracted to you either in a bespoke contract or on standard T&Cs, or is your business more relationship based? Think about the really important relationships and the extent to which they are committed to you. For key customers or suppliers who do have contracts, have they expired or will they expire soon, and can you firm those up with a renewal or a new contract? Refrain from rushing in to change the status quo without careful and strategic thought.

3. Are all your Related party transactions tidy and documented?

Balance sheets can become littered with related party transactions, sometimes blurring the lines between professional and personal finances of the company and its shareholders. Clean those up if you can. There may be some easy wins by repaying some loans or setting them off against each other. If there are genuine shareholder loans in place, record the terms properly in a loan agreement.

4. Have you got clean financial statements and management accounts and are you up-to-date with your taxes?

This is obvious, but make sure the business has its accounts and taxes up-to-date and in order, and have financial and tax information easily accessible and well organised in anticipation of due diligence. If last year’s accounts haven’t been signed off yet, get it done. The easier it is for a purchaser to do financial and tax due diligence the better. You want to demonstrate that the business is well run and meeting its obligations.

5. Are your company records up-to-date, especially your share register? Do you need to put these in place or tidy them up?

Every company is required to maintain certain records at its registered office, including copies of resolutions/minutes of directors and shareholders, an interests register, registers of directors and addresses, and most importantly the share register. A properly maintained share register is critical to any share deal. Under the Companies Act 1993, your name on the share register is evidence you own the shares ascribed to you on that share register. The shareholder details for your company on the Companies Office website is not your share register. A surprising number of SMEs aren’t aware of these requirements and the importance of the share register. Get your records in order by collating and organising all of your resolutions in one place, and make sure you know where your share register is and that it is up-to-date. It builds confidence and demonstrates the business is well run.

This is by no means an exhaustive list.

What else can I do to get ready for sale?

If you are serious about selling your business, one good strategy is to take an holistic view of your business from a purchaser’s perspective and then take 3-12 months to make your business more sale ready. If you have the time to do this, it can result in higher value and better outcomes. Your lawyer and accountant can help you plan and identify what you need to get ready for sale.

Contact our Corporate and Commercial team, reach out to your usual CLM contact, or get in touch with Andy directly, we’d be happy to talk to you about getting"sale ready".

3. When to call your advisors and how to use them wisely

A short section this time, because if you have read this far, you already know the answer.

Early. Early. Early.

But why? Won’t that cost money that might be wasted if we don’t sell? Yes. But an investment in planning now will save money in the long run and improve your chances of getting the deal you want.

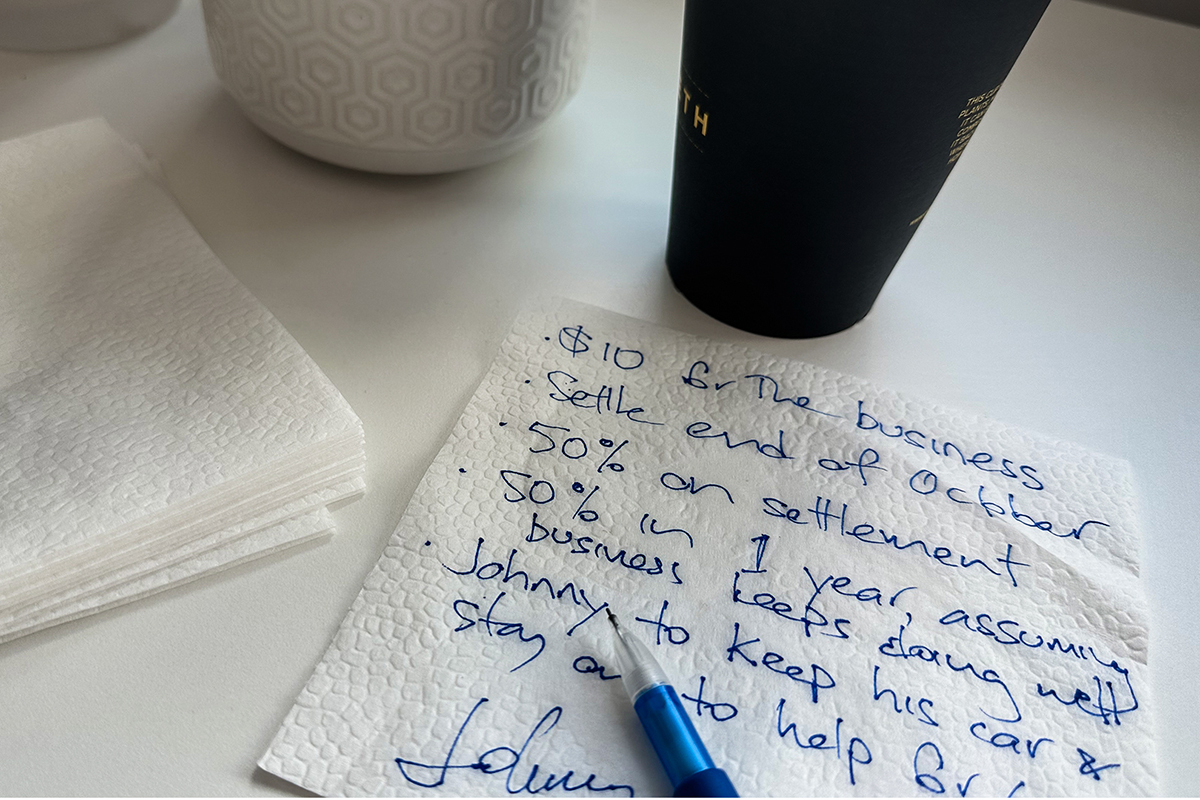

Lawyers are often engaged too late and the opportunity to leverage their expertise can be lost. A client may call to say a deal has been struck and needs recording, but it soon becomes clear that the deal has some fishhooks and deficiencies, and unfortunately the opportunity to address those issues has passed. This happens more often than you would think. The better strategy for the client would have been to consult first and make a deal second, not the other way around.

An initial chat with your lawyer can cover a myriad of things and will help lay a good foundation:

- What is the best structure, an asset deal or share deal?

- Do you want a full exit or a partial exit?

- Will you be happy to work in the business post-sale?

- What could you do to make the business more ready for sale?

- Is a vendor due diligence process to identify potential issues appropriate?

- Do you have an idea of value?

- What time frame are you trying to meet?

- Are there some key terms you need?

- Have you identified or talked to likely purchasers?

- If so, have you got confidentiality agreements in place?

- If not, do you need some help finding a purchaser?

It may take more than one conversation to cover this ground, but the clarity that early planning provides can be invaluable.

For bigger transactions, there may be some value in having an initial discussion with a deal advisory team. These teams often sit within accounting firms and there are also boutique deal advisory businesses that can help. They specialise in running sales processes for vendors and can help you assess value, package up the business for sale, identify, contact and liaise with potential purchasers and with closely with you and your lawyer to manage the process. Our C&C team can recommend some deal advisory teams.

This guide to selling your business is intended to help you understand the basic sales process and introduce you to some key concepts and ideas. There is no magic to any of the information presented here, but having a grasp on it will get you one step ahead of the game. The special sauce that you want a lawyer to provide is how to apply all of this to your circumstances and get you the best result, and our experienced C&C team is very well placed to assist you.

Resist the temptation to agree a deal on the back of a napkin unless you have already lined up your fundamentals. Let those with expertise help, the earlier the better.

4. The sale process from start to finish: SPAs and other jargon

The best way to sell a business depends on the business itself, but the broad process remains the same.

- Meeting a prospective purchaser

- Confidentiality and exclusivity

- Due diligence and data rooms

- Drafting and negotiating the Sale and Purchase Agreement (SPA)

- Completing the transaction

1. Meeting a prospective purchaser

Receiving unsolicited offers or expressions of interest, confidentially approaching a viable candidate, or reaching out to the market directly, are all ways in which vendors and purchasers can be connected.

You may already know who your most likely purchasers are. The key is how to approach them, especially if they are competitors. There may be value in engaging a deal advisory team or an experienced business broker that has your best interests at heart. Among other things, they can research markets, package up information about your business, and find and approach prospective purchasers.

Some businesses are excellent candidates for competitive sales processes. This is where deal advisory teams shine. The idea is to create competitive tension and then manage the selection of a preferred bidder based on indicative offers.

2. Confidentiality and exclusivity

The very fact your business may be available for sale is often commercially sensitive, so the manner in which you meet and engage with potential purchasers can be critical.

Before engaging in any discussions with a potential purchaser about selling your business you should put in place a confidentiality agreement. Confidentiality agreements come in different forms for different purposes, and there are special issues to consider and clauses to include when discussing a prospective sale transaction.

A purchaser may want exclusive dealings with you for a certain period to ensure that it can invest time and resource in the due diligence process with the confidence of your commitment to them. A preliminary agreement is often entered into to record the purchaser’s non-binding indicative offer, and that agreement will usually contain legally binding provisions exclusivity.

3. Due diligence and data rooms

Most purchasers want to do a due diligence review of your business before committing to buy a business. The vendor needs to collate and make available to the purchaser certain information about the target business.

Due diligence usually covers three areas – legal, financial (and tax), and operational/technical. The size and nature of the business will dictate what and how much the purchaser wants to review.

For small businesses, due diligence may be limited to a small number of key documents in one or two physical folders or a cloud storage folder (e.g. Google Drive or Dropbox). Documents may include corporate records, leases or records of title, employee lists and employment agreements, standard T&Cs; key contracts, financial statements, and some tax returns. There may also be a due diligence questionnaire to provide written responses to, that enquires about other areas of the business (eg litigation, product recalls, H&S etc).

For larger transactions, there can be a lot of information to collate and organise. It is usually posted into a secure online data room that only you and the purchaser (and your respective advisors) can access. That information is reviewed in detail by the purchaser and its advisors (lawyers, accountants and operational specialists). There may also be a Q&A process, which allows reviewers to ask further questions about the materials reviewed. The due diligence findings then inform the purchaser’s SPA negotiations. The purchaser’s findings may impact deal terms and come as a surprise to the vendor – which leads us to vendor due diligence.

Vendor due diligence is when the vendor does its own due diligence on itself first, in order to discover any major issues a purchaser is likely to find during its due diligence. Vendor due diligence is not an essential part of selling your business, but forewarned is forearmed. Uncovering unknown issues before inviting purchaser to do due diligence allows a vendor to take appropriate steps in advance and avoid a nasty surprise.

By its very nature, the due diligence process can give someone a lot of detailed information about your business. This is especially sensitive if a prospective purchaser is a competitor. For this reason, the level of detail you put in the data room needs to be considered. Redacting certain information from documents and holding other sensitive documents back in a “black box” is a common strategy. The black box is only released as part of a second stage of due diligence once the purchaser has confirmed it is keen to proceed.

Thorough due diligence reviews are important for larger deals. That is especially the case if warranty and indemnity insurance will be put in place to cover the risk of a claim arising under the SPA. Warranty and indemnity insurance is a topic in itself and is not covered in detail here but suffice to say, the better the due diligence the better the insurance cover.

Setting up data rooms and dealing with Q&A is time consuming. The due diligence process for a larger transaction can take on a life of its own. Don’t underestimate the investment in resource required to do this properly, and consider engaging temporary resource to ensure you can keep pace with the demands of due diligence and also ensure the day to day running of the business remains a priority.

4. Drafting and negotiating the SPA and other transaction documents

There is no one template SPA that works for all transactions, every deal is unique. Small asset sales are often documented using the ADLS (Auckland District Law Society, recently renamed The Law Association Inc.) standard form for sale and purchase of business and assets, with further deal specific terms appended to it. For larger deals (asset or share deals) the SPAs are usually bespoke.

And as a rule, vendors should control the first draft of the transaction documents to make sure they reflect key terms and the vendor’s risk profile. It is often a false economy to let the purchaser prepare a first draft because the money saved not preparing that draft soon gets spent on negotiating away the purchaser friendly terms.

The SPA negotiation is undertaken by the lawyers with the instructions of their clients. That means you have to work closely with your lawyers to understand the documents and the issues, so you can make the best decisions for the best outcome.

5. Completing the transaction

Once a SPA has been signed, the next step is satisfying the conditions (if any), and then working towards completion (also known as “settlement” or “closing”). On the completion date the vendor and the purchaser each have a list of things to do to complete the sale and purchase of the business. Once all those things are done, the transaction has “completed”.

Thoughts

The complexity of a business sale transaction usually corresponds to the size, value and complexity of the business and of the deal that has been struck.

Selling a smaller business with The Law Association Inc’s (formerly ADLS) standard form is usually straight forward but it can throw up some curl balls, which then need to be dealt with using the “further terms” section. Selling a bigger business with a bespoke SPA following a significant due diligence exercise can also be relatively straight forward, but it takes a lot more time, effort and cost, and negotiations may be extensive and more technical.

What would the process look like for my business?

Contact our Corporate and Commercial team, reach out to your usual CLM contact, or get in touch with Andy directly.

5. Formulating a deal structure that works for you and your business

How do I sell thee, let me count the ways…

The cleanest deal is 100% of the purchase price paid in cash on completion, with the vendor handing over the business and walking away on completion.

But variations on the theme soon arise.

1. Upfront and earn-out payments

The value of the business may be hard to determine or the parties have different views about how realistic the current profitability or growth trajectory is. The purchaser may agree to pay the vendor an amount upfront and then another “earn-out” payment in the future, based on the trading results of the business over the next one, two, or even three years.

2. EBITDA

Or the business value may be based on EBITDA multiplied by an industry specific multiple. The valuation may assume a “cash free, debt free position, with normalised working capital”. In that case, the purchaser will pay an amount on completion, with a wash up 2 or 3 months later once the actual financial position of the target on the completion date is determined. The wash up will require the purchaser to pay more to the vendor, or the vendor to repay some of the completion payment to the purchaser, depending on where the numbers fall.

3. Hold back

Sometimes the parties already have an idea that the vendor will need to repay money based on the purchase price adjustment mechanism, or perhaps there are a large number of selling shareholders, which would make arranging separate repayments by each of the vendors impractical. In that case, there may be a “hold back”, where the purchaser pays a certain amount on completion, but holds back the rest until a later date. If the purchase price adjustment results in the vendor repaying an amount to the purchaser (or there is a claim under the SPA), the purchaser can set off the amount owed against the hold back and pay the balance.

In some circumstances the parties may prefer the hold back to be held in escrow by an escrow agent, and released to the vendors or repaid to the purchaser strictly in accordance with the terms of an escrow agreement.

4. Locked box

Sometimes the valuation is based on slightly older accounts and the SPA imposes tight restrictions on what the business and the shareholders can or cannot do between signing and completion to ensure the status quo is maintained. This is called a “locked box” and the focus is on ensuring there is no “leakage” of value to the shareholders other than strictly as agreed by the purchaser.

5. Reinvesting

Some purchasers (especially private equity purchasers) like vendors to reinvest a portion of the purchase price into the business. This means less cash upfront but the ability to share in any further uplift on a future exit.

6. Should I stay or should I go?

A purchaser may require that key personnel (including a vendor) stay on post-completion, to achieve a smoother transition, continuity of relationships and retention of expertise in the short term.

There is little merit in agreeing to stay on for 24 months if you actually just want to walk away and pursue other interests. On the other hand, a sale of 100% of the business with you staying involved for a while to ensure the best value is realised from the sale, may be a really good option. For example, you might want to stay on as an employee to continue to earn an income without the pressure of business ownership, or maybe you’ve agreed to an earn-out and you want to stay on in a capacity that gives you real influence and control to ensure earn out thresholds are reached.

There is also another important factor to consider - it is not always easy to keep working in the business you used to own when someone else has taken the reins. Vendors staying in the business need to make peace with their new role and keep their “why” in the forefront of their minds.

While we’re on the topic of selling businesses and handing over the reins, another CLM article that may be relevant to you is Succession planning for business.

Summary

For a vendor, there are pros and cons around earn-outs, reinvesting sales proceeds or taking shares in the purchaser as part of the purchase price. It introduces both risk and opportunity in terms of any future returns and that needs to be weighed up against getting all your cash out up front. A vendor needs to decide whether a bird in the hand is worth two in the bush. A vendor also has to decide how long they want to remain involved in the business post-completion, if at all.

The important thing is that the overall deal structure has to work for you. Knowing from the outset what you want to achieve and what you are willing to compromise on will help determine transaction structures that will work and those that won’t.

6. The Anatomy of a Sale and Purchase Agreement

It’s very helpful to know your way around a SPA. They can be lengthy documents and difficult to digest, but they all broadly follow the same formula.

Below is a brief description of a common SPA and what it includes.

1. Parties names

Every SPA starts with the full legal names of the parties. A brief background section then describes the sale transaction. This is usually followed by definitions and interpretation rules. Definitions make a document clearer and increase certainty, but sometimes you’d be forgiven for thinking the opposite is true based on the number of definitions.

2. Sale and Purchase

There is usually a clear statement upfront that the vendor agrees to sell and the purchaser agrees to buy the assets and business/shares on the completion date for the purchase price.

3. Conditions

The deal may be conditional on certain things happening (or not happening) by agreed dates. Conditions may include obtaining certain third party consents (eg the landlord under a lease); meeting a regulatory condition (eg obtaining overseas investment office approval); or securing key personnel. Conditions have to be satisfied or waived by the agreed date, and the SPA can be terminated by either party if they are not.

4. Purchase Price and Purchase Price Adjustment

The purchase price needs to be clearly stated and specify how GST is to be treated. If there is a purchase price adjustment mechanism, it needs to be clearly set out and will usually refer to detailed policies and calculation methods set out in schedules to the SPA.

5. Pre Completion obligations and restrictions

In the interim period between signing and completion, there are certain things a vendor may do, must do, and must not do. This targets business continuity, maintaining status quo in the ordinary course of business, and preserving value. Non-compliance may give the purchaser a termination right or a claim against the vendors. The length of the interim period will usually be detemined by the time required to satisfy the conditions. Generally speaking, shorter interim periods are often preferred by vendors and purchasers alike, to minimise the risk of new circumstances arising that could impact the deal.

6. Completion mechanics

This clause lists what the vendor and purchaser each have to do to effect completion. The vendor has to deliver the assets (and their instruments of transfer) or the share transfer forms, and all the other specified deliverables required to give effect to the sale, while the purchaser’s main obligation is usually to pay the purchase price. The SPA will specify what happens if someone defaults.

7. Post Completion obligations

There may be a list of specific things to do post completion, for example, attend to certain paperwork, issue an announcement to media, update Companies Office details, or change a company name.

8. Restraints

Vendors are often required to sign up to restraints, usually for non-competition and non-solicitation of clients and/or employees. Restraints always have to be reasonable, but generally speaking stronger restraints are more enforceable in the context of a business sale, especially if the purchase price (or the goodwill component) is significant. Restrained persons usually have to be parties to the SPA in their personal capacities for the purposes of this clause, even if they already sign the SPA for and on behalf of the vendor.

9. Warranties

Warranties are statements about the business. Warranties usually have to be true and correct on the signing date and are given again on the completion date. If a warranty turns out to be untrue and that causes loss to the purchaser (eg the business isn’t worth as much as was paid for it), then that may give rise to a claim against the vendor for that loss. Warranties can relate to any other area of the business. The most basic or “fundamental” warranties are about title and capacity – that the vendor owns the relevant shares or assets being sold and is entitled to sell them under the SPA. Warranties are often qualified by fair disclosures – if the purchaser knew about an issue that makes a warranty untrue, then no claim can be brought in respect of that issue. This is where getting the terms of the SPA right and making proper disclosures during due diligence are critical.

10. Indemnities

Sometimes the purchaser identifies a particular issue and requires an indemnity from the vendor for any loss arising from that issue. Two examples from recent trends are having an indemnity for any historical miscalculation of holiday pay, and being indemnified for any clawback of COVID-19 wage subsidies that were not justifiably claimed or retained.

11. Limitations on Liability

Claims under warranties and indemnities need to be brought within a specific time period, provided that they claims meet certain monetary thresholds. The amount payable for a successful warranty or indemnity claim is usually capped at an agreed percentage of the purchase price (up to 100%). Generally speaking, a vendor prefers a short claims period with high thresholds and a low maximum claim cap, while a purchaser prefers a longer claims period, lower thresholds and a higher maximum claim cap.

12. W&I insurance

In some larger deals, the parties may agree to obtain an insurance policy that covers the risk of a claim under a warranty or indemnity. If the loss payable for a warranty or indemnity claim can be insured, the vendor then has the freedom to distribute sale proceeds immediately instead of having to consider putting some aside until the claims period expires. Private equity and venture capital vendors often require W&I insurance to enable prompt distributions to their investors. For a lost of smaller mid-market deals, W&I insurance is often cost prohibitive.

13. Schedules

The schedules include a lot transaction specific information and details. These may include descriptions and lists of key assets, the list of vendor warranties, purchase price adjustment mechanisms, earn-out mechanics, and a range of other information.

It’s important to reiterate that there is no one size fits all form of SPA. The form of SPA will be dictated by the size and nature of the business and the structure of the sale transaction, but irrespective of the purchase price, most SPAs will broadly follow this basic format.

The Wrap Up

We trust that this guide gives you some more insight into what may be involved in selling your business or is a helpful refresher course for those that have been through it before.

We hope you feel more informed and empowered, and that you now have a better idea of what to ask your lawyer and accountant, and what they are likely to ask you.

Here’s some key thoughts to take away with you.

- Selling your business requires some forethought and planning to get the best outcome.

- Resist the urge to make a “back of a napkin” deal.

- Know your fundamental requirements and make a deal that works for you.

- Involve your advisors early, the investment upfront will pay off.

- A “one size fits all” SPA template is as elusive as the yeti, but for smaller transactions The Law Association Inc (formerly ADLS) standard form may be an appropriate and cost effective starting point.

- Bespoke sale and purchase agreements are standard practice for larger or more complicated asset or share deals.

- The right starting point for your deal must reflect the key features of your deal. Retrofitting key features to the wrong starting point can be done but it is not ideal and it incurs unnecessary cost.

- It is normal that the vendor controls the first draft of the SPA, it may be a false economy to let the purchaser produce the first draft.

- Be prepared - a sales process can be time consuming (especially due diligence), dedicating resource and working closely with your deal team and advisors is the most efficient way through.

It is always best to go into a sales transaction with your eyes open, knowing what it entails. You need to work with trusted advisors who will look after your interests.

How can Cooney Lees Morgan help me?

The Corporate & Commercial Team at Cooney Lees Morgan is well placed to assist you with your business sale, whether big or small. Our team includes experienced and respected M&A specialists who can work with you on your transaction from start to finish and provide you expertise and a level of assistance that matches your needs and particular circumstances.

As a full service firm we can lean on the expertise of our other specialists, such as our property or employment teams, and other practice areas relevant to your situation. We can also put you in touch with deal advisory teams and other financial or accounting specialists where helpful.

If you are about to embark on a sales process, or if you aren’t quite ready to sell but want to explore the idea of selling or inviting further investment into your business, we would be happy to sit down with you to talk through your options.

Selling your business is not running your business. Let us help you get the best result.

Want to get advice on selling your business? Contact us for an obligation free chat.

Contact our Corporate and Commercial team, reach out to your usual CLM contact, or get in touch with Andy directly, we’d be happy to talk to you about selling your business.

Andy Martin

Special Counsel

Phone: +64 7 927 0588

Email: amartin@clmlaw.co.nz

Corporate and Commercial Team Contacts

Senior Associate

Associates

Solicitors